Use these links to rapidly review the document

TABLE OF CONTENTS

HUNTSMAN INTERNATIONAL LLC AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on February 13, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HUNTSMAN INTERNATIONAL LLC*

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

2800 (Primary Standard Industrial Classification Code Number) |

87-0630358 (I.R.S. Employer Identification Number) |

500 Huntsman Way

Salt Lake City, UT 84108

(801) 584-5700

(Address, Including Zip Code and Telephone Number, Including Area Code, of Registrants' Principal Executive Offices)

David M. Stryker, Esq.

Executive Vice President, General Counsel and Secretary

Huntsman International LLC

500 Huntsman Way

Salt Lake City, UT 84108

(801) 584-5700

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copy to:

Nathan W. Jones, Esq.

Robbie G. Yates, Esq.

Stoel Rives LLP

201 South Main Street, Suite 1100

Salt Lake City, UT 84111

(801) 328-3131

Approximate date of commencement of proposed sale of the securities to the public:

The exchange offer will occur as soon as practicable after the effective date of this registration statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Note |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

5.125% Senior Notes due 2021 |

€300,000,000(1) | 100%(2)(3) | €300,000,000(1)(2) | $52.605(4) | ||||

Guarantees of 5.125% Senior Notes due 2021 |

(5) | (5) | (5) | (5) | ||||

|

||||||||

The Registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Additional Registrants

Exact Name of Additional Registrants*

|

Jurisdiction of Incorporation/Organization |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification Number |

||||||

|---|---|---|---|---|---|---|---|---|---|

Airstar Corporation |

Utah | 2800 | 87-0457111 | ||||||

Huntsman Advanced Materials Americas LLC |

Delaware | 2800 | 52-2215309 | ||||||

Huntsman Advanced Materials LLC |

Delaware | 2800 | 92-0194012 | ||||||

Huntsman Australia LLC |

Utah | 2800 | 87-0510821 | ||||||

Huntsman Australia Holdings LLC |

Utah | 2800 | 87-0620479 | ||||||

Huntsman Chemical Purchasing LLC |

Utah | 2800 | 87-0568517 | ||||||

Huntsman Enterprises LLC |

Utah | 2800 | 87-0562447 | ||||||

Huntsman Ethyleneamines LLC |

Texas | 2800 | 87-0668124 | ||||||

Huntsman Fuels LLC |

Texas | 2800 | 91-2085706 | ||||||

Huntsman International Financial LLC |

Delaware | 2800 | 87-0632917 | ||||||

Huntsman International Fuels LLC |

Texas | 2800 | 91-2073796 | ||||||

Huntsman International Trading Corporation |

Delaware | 2800 | 87-0522263 | ||||||

Huntsman MA Investment Corporation |

Utah | 2800 | 87-0564509 | ||||||

Huntsman MA Services Corporation |

Utah | 2800 | 87-0661851 | ||||||

Huntsman Petrochemical LLC |

Delaware | 2800 | 58-1594518 | ||||||

Huntsman Petrochemical Purchasing LLC |

Utah | 2800 | 87-0568520 | ||||||

Huntsman Procurement LLC |

Utah | 2800 | 87-0644129 | ||||||

Huntsman Propylene Oxide LLC |

Texas | 2800 | 91-2073797 | ||||||

Huntsman Purchasing, Ltd. |

Utah | 2800 | 84-1370346 | ||||||

Huntsman Surfactants Technology Corporation |

Utah | 2800 | 87-0620480 | ||||||

Tioxide Americas (Holdings) LLC |

Delaware | 2800 | 27-4242817 | ||||||

Tioxide Americas LLC |

Cayman Islands | 2800 | 98-0015568 | ||||||

Tioxide Group |

U.K. | 2800 | 98-0207605 | ||||||

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any State in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such State.

SUBJECT TO COMPLETION—DATED FEBRUARY 13, 2014

PRELIMINARY PROSPECTUS

![]()

Huntsman International LLC

Offer to exchange €300,000,000 aggregate principal amount of

5.125% Senior Notes due 2021

which have been registered under the Securities Act

for

€300,000,000 aggregate principal amount of

5.125% Senior Notes due 2021

This exchange offer will expire at 5:00 p.m., New York City Time,

on , 2014 unless extended.

Terms of the exchange offer:

See the "Description of New Notes" section on page 182 for more information about the new notes to be issued in this exchange offer.

This investment involves risks. See the section entitled "Risk Factors" that begins on page 14 for a discussion of the risks that you should consider prior to tendering your old notes for exchange.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of the new notes it receives. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act of 1933, as amended. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where such old notes were acquired by the broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 120 days after the consummation of the exchange offer, we will make this prospectus, as amended and supplemented, available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

We file annual, quarterly and certain other reports with the Securities and Exchange Commission jointly with our parent, Huntsman Corporation. Because Huntsman Corporation is not an obligor or guarantor under the notes and is not a registrant under the registration statement of which this prospectus is a part, certain notes to the financial statements included in this prospectus that relate solely to Huntsman Corporation have been omitted and are marked "[Reserved]."

This prospectus incorporates important business and financial information about our Company that is not included in or delivered with this prospectus. This information is available without charge upon written or oral request. See "Where You Can Find More Information." To obtain this information in a timely fashion, you must request such information no later than five business days before the expiration of the exchange offer. UNLESS WE EXTEND THE EXCHANGE OFFER, THE LATEST YOU SHOULD REQUEST COPIES OF THESE DOCUMENTS IS , 2014.

i

The following summary highlights selected information from this prospectus and may not contain all the information that is important to you. This prospectus contains information regarding our business and detailed financial information. You should carefully read this entire document.

We are a wholly-owned subsidiary of Huntsman Corporation, which we refer to in this prospectus as our "parent." Unless the context otherwise requires: references in this prospectus to "we," "us," "our" or "our Company" refer to Huntsman International LLC, together with its subsidiaries, and not to Huntsman Corporation and its other subsidiaries; references to "guarantors" or "guarantor subsidiaries" refer to our subsidiaries that have guaranteed our debt obligations, including the notes, consisting of substantially all of our domestic subsidiaries and certain of our foreign subsidiaries; "HPS" refers to Huntsman Polyurethanes Shanghai Ltd. (our consolidated splitting joint venture with Shanghai Chlor-Alkali Chemical Company, Ltd); "SLIC" refers to Shanghai Liengheng Isocyanate Investment BV (our unconsolidated manufacturing joint venture with BASF AG and three Chinese chemical companies); "Sasol-Huntsman" refers to Sasol-Huntsman GmbH and Co. KG (our consolidated joint venture with Sasol that owns and operates a maleic anhydride facility in Moers, Germany); and "HCCA" refers to Huntsman Chemical Company Australia Pty Limited (our 100% owned subsidiary).

In this prospectus, we may use, without definition, the common names of competitors or other industry participants. We may also use the common names or abbreviations for certain chemicals or products. Many of these terms are defined in the Glossary of Chemical Terms on page 112 below.

Overview

We are a global manufacturer of differentiated organic chemical products and of inorganic chemical products. Jon M. Huntsman founded the predecessor to our Company as a small polystyrene plastics packaging company. Since then, we have grown through a series of significant acquisitions and now own a global portfolio of businesses. In 2005, our parent completed an initial public stock offering. We operate in five segments: Polyurethanes, Performance Products, Advanced Materials, Textile Effects and Pigments. Our products comprise a broad range of chemicals and formulations, which we market globally to a diversified group of consumer and industrial customers. Our products are used in a wide range of applications, including those in the adhesives, aerospace, automotive, construction products, personal care and hygiene, durable and non-durable consumer products, electronics, medical, packaging, paints and coatings, power generation, refining, synthetic fiber, textile chemicals and dye industries. We are a leading global producer in many of our key product lines, including MDI, amines, surfactants, epoxy-based polymer formulations, textile chemicals, dyes, maleic anhydride and titanium dioxide. Our administrative, research and development and manufacturing operations are primarily conducted at the facilities listed below under "Business—Properties," which are located in more than 30 countries. As of December 31, 2013, we employed approximately 12,000 associates worldwide. Our revenues for the years ended December 31, 2013, 2012 and 2011 were $11,079 million, $11,187 million and $11,221 million, respectively.

Our company was organized in 1999 as a Delaware limited liability company. Our principal executive offices are located at 500 Huntsman Way, Salt Lake City, Utah 84108, and our telephone number at that location is (801) 584-5700.

1

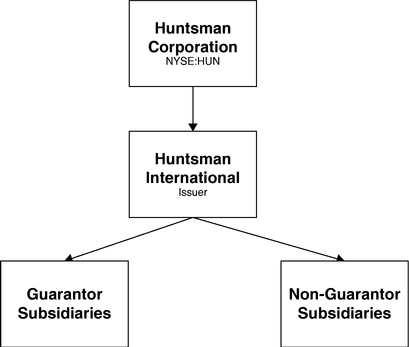

The chart below generally illustrates our organizational structure:

Recent Developments

For a discussion of recent developments, see "Business—Recent Developments" below.

2

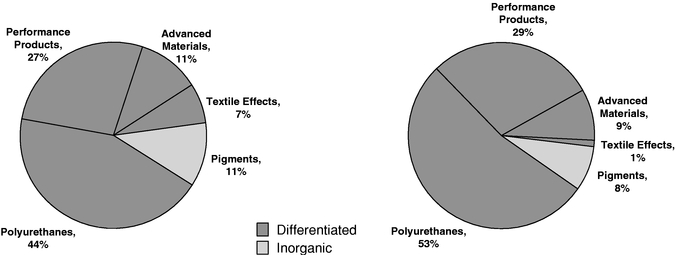

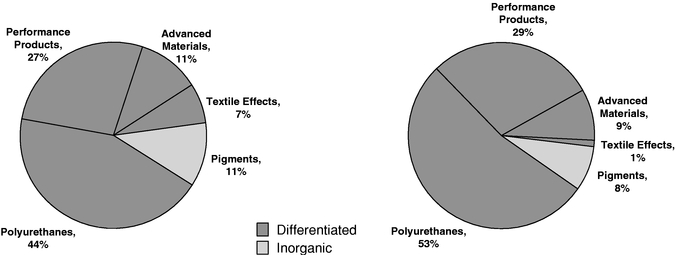

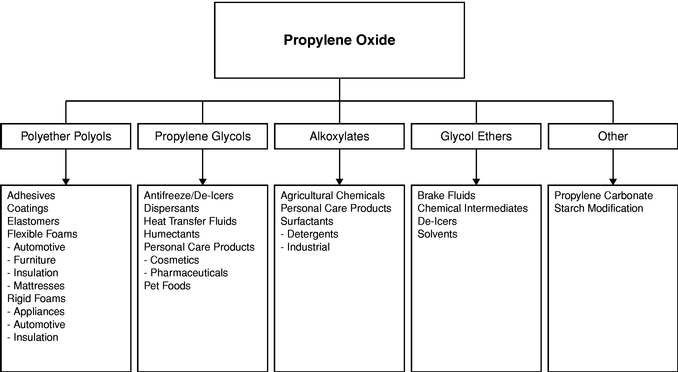

Our Products

We produce differentiated organic and inorganic chemical products. Our Polyurethanes, Performance Products, Advanced Materials and Textile Effects segments produce differentiated organic chemical products and our Pigments segment produces inorganic chemical products.

Growth in our differentiated products has been driven by the substitution of our products for other materials and by the level of global economic activity. Accordingly, the profitability of our differentiated products has been somewhat less influenced by the cyclicality that typically impacts the petrochemical industry. Our Pigments segment, while cyclical, is influenced by seasonal demand patterns in the coatings industry.

| 2013 Segment Revenues(1) | 2013 Segment Adjusted EBITDA(1) |

3

The following table identifies the key products, their principal end markets and applications and representative customers of each of our segments:

Segment

|

Products | End Markets and Applications |

Representative Customers |

|||

|---|---|---|---|---|---|---|

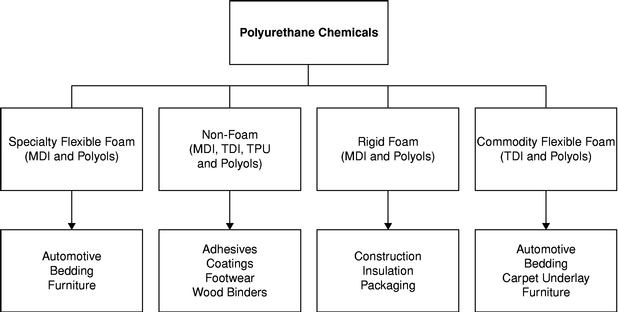

| Polyurethanes | MDI, PO, polyols, PG, TPU, aniline and MTBE | Refrigeration and appliance insulation, construction products, adhesives, automotive, footwear, furniture, cushioning, specialized engineering applications and fuel additives | BMW, CertainTeed, Electrolux, Firestone, Haier, Henkel, Johnson Controls, Louisiana Pacific, PMI, Weyerhaeuser | |||

| Performance Products | Amines, surfactants, LAB, maleic anhydride, other performance chemicals, EG, olefins and technology licenses | Detergents, personal care products, agrochemicals, lubricant and fuel additives, adhesives, paints and coatings, construction, marine and automotive products, composites, and PET fibers and resins | Afton, Chevron, Dow, Henkel, L'Oreal, Lubrizol, Monsanto, Procter & Gamble, Reichhold, Sun Products, Unilever | |||

| Advanced Materials | Basic liquid and solid epoxy resins; specialty resin compounds; cross-linking, matting and curing agents; epoxy, acrylic and polyurethane-based formulations | Aerospace and industrial adhesives, composites for aerospace, automotive, and wind power generation; construction and civil engineering; industrial coatings; electrical power transmission; consumer electronics | AkzoNobel, Bodo Moller, Cytec, Freeman, Hexcel, Lianyungang, Omya, PPG, Ribelin, Schneider, Sherwin Williams, Siemens, Speed Fair, Syngenta, Toray | |||

| Textile Effects | Textile chemicals and dyes | Apparel, home and technical textiles | Aunde, Esquel Group, Fruit of the Loom, Guilford Mills, Hanesbrands, Nice Dyeing, Polartec, Tencate, Y.R.C., Zaber & Zubair | |||

| Pigments | Titanium dioxide | Paints and coatings, plastics, paper, printing inks and ceramics | AkzoNobel, Clariant, Jotun, PolyOne, PPG |

4

THE EXCHANGE OFFER

Securities Offered |

€300,000,000 aggregate principal amount of new notes which have been registered under the Securities Act of 1933, as amended (the "Securities Act"). The terms of the new notes are substantially identical to the old notes, except that certain transfer restrictions, registration rights and liquidated damages provisions relating to the old notes do not apply to the registered new notes. | |

The Exchange Offer |

We are offering to issue registered new notes in exchange for like principal amount and like denomination of our old notes. We are offering to issue these registered new notes to satisfy our obligations under an exchange and registration rights agreement that we entered into with the initial purchasers of the old notes when we sold them in a transaction that was exempt from the registration requirements of the Securities Act. You may tender your old notes for exchange by following the procedures described under the heading "The Exchange Offer." |

|

Tenders; Expiration Date; Withdrawal |

The exchange offer will expire at 5:00 p.m., New York City time, on , 2014, unless we extend it. The exchange offer will be open for at least twenty (20) business days to ensure compliance with Rule 14e-1(a) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). If you decide to exchange your old notes for new notes, you must acknowledge, among other things, that you are acquiring the new notes in the ordinary course of your business, that you have no arrangement or understanding with any person to participate in a distribution of the new notes and that you are not an affiliate of our Company. You may withdraw any notes that you tender for exchange at any time prior to 5:00 p.m., New York City time, on the expiration date. If we decide for any reason not to accept any old notes you have tendered for exchange, those notes will be returned to you without cost promptly after the expiration or termination of the exchange offer. See "The Exchange Offer—Terms of the Exchange Offer" and "—Withdrawal Rights" for a more complete description of the tender and withdrawal provisions. |

|

Conditions to the Exchange Offer |

The exchange offer is subject to customary conditions and we may terminate or amend the exchange offer if any of these conditions occur prior to the expiration of the exchange offer. These conditions include any change in applicable law or legal interpretation or governmental or regulatory actions that would impair our ability to proceed with the exchange offer, any general suspension or general limitation relating to trading of securities on any national securities exchange or the over-the-counter market or a declaration of war or other hostilities involving the United States. We may waive any of these conditions in our sole discretion. |

5

Procedures for Tendering Old Notes |

To tender book-entry interests in old notes in the exchange offer, the holder of the old notes on the records of Euroclear or Clearstream, Luxembourg must contact either Euroclear or Clearstream, Luxembourg to arrange to block such holder's account. In lieu of delivering a letter of transmittal to Citibank, N.A. (the "exchange agent"), you must, unless otherwise instructed by Euroclear or Clearstream, Luxembourg, notify Euroclear or Clearstream, Luxembourg, as the case may be, to deliver to the exchange agent prior to 5:00 p.m., New York City time, on the expiration date, a computer-generated message, in which the holder of the old notes acknowledges and agrees to be bound by the terms of the letter of transmittal. In all other cases, a letter of transmittal must be manually executed and received by the exchange agent before 5:00 p.m., New York City time, on the expiration date. |

|

Exchange Offer; Exchange and Registration Rights |

The old notes were sold pursuant to a purchase agreement dated December 11, 2013. Under the exchange and registration rights agreement, we have agreed to use our reasonable best efforts to commence and consummate the exchange offer within 45 days after the date on which the registration statement of which this prospectus is a part is declared effective. In addition, we have agreed to file a "shelf registration statement" that would allow some or all of the old notes to be offered to the public if we are unable to complete the exchange offer or a change in applicable laws or legal interpretation occurs that would limit the intended effects or availability of the exchange offer. |

|

Penalty Interest |

If we fail to fulfill certain obligations under the exchange and registration rights agreement, including if the registration statement of which this prospectus is a part is not declared effective by the Securities and Exchange Commission, or SEC, on or before September 19, 2014 or if the exchange offer has not been completed within 45 days after the effective date of such registration statement (a "registration default"), the annual interest rate on the notes will increase by 0.125% during the first 90-day period during which the registration default continues, and will increase by an additional 0.125% for each subsequent 90-day period during which the registration default continues, up to a maximum increase of 0.50% over the interest rate that would otherwise apply to the old notes. As soon as we cure a registration default, the interest rates on the notes will revert to their original levels. |

|

U.S. Federal Tax Consequences |

Your exchange of old notes for new notes in the exchange offer will not result in any gain or loss to you for United States federal income tax purposes. See "Material United States Federal Income Tax Consequences." |

6

Use of Proceeds |

We will not receive any cash proceeds from the exchange offer. In consideration for issuing the new notes in the exchange offer as contemplated in this prospectus, we will receive in exchange old notes in like principal amount, which will be cancelled and as such will not result in any increase in our indebtedness. We will pay all expenses incident to the exchange offer. See "Use of Proceeds" for a discussion of the use of proceeds from the issuance of the old notes. |

|

Listing |

The notes are listed on the Official List of the Luxembourg Stock Exchange and admitted for trading on the Luxembourg Stock Exchange's Euro MTF Market. The Euro MTF Market is not a regulated market for purposes of the provisions of Directive 2004/39/EC. |

|

Trustee |

Wilmington Trust, National Association |

|

Paying Agent |

Citibank, N.A., London Branch |

|

Registrar and Transfer Agent |

Citibank, N.A., London Branch |

|

Luxembourg Listing Agent |

Banque Internationale à Luxembourg |

|

Consequences of Failure to Exchange |

Old notes that are not tendered or that are tendered but not accepted will continue to be subject to the restrictions on transfer that are described in the legend on those notes. In general, you may offer or sell your old notes only if they are registered under, or offered or sold under an exemption from, the Securities Act and applicable state securities laws. We, however, will have no further obligation to register the old notes. If you do not participate in the exchange offer, the liquidity of your notes could be adversely affected. |

|

Consequences of Exchanging Your Old Notes |

Based on interpretations of the SEC set forth in certain no-action letters issued to third parties, we believe that you may offer for resale, resell or otherwise transfer the new notes that we issue in the exchange offer without complying with the registration and prospectus delivery requirements of the Securities Act if you: |

|

|

• acquire the new notes issued in the exchange offer in the ordinary course of your business; |

|

|

• are not participating, do not intend to participate, and have no arrangement or understanding with anyone to participate, in the distribution of the new notes issued to you in the exchange offer; and |

|

|

• are not an "affiliate" of our Company as defined in Rule 405 of the Securities Act. |

7

|

If any of these conditions are not satisfied and you transfer any new notes issued to you in the exchange offer without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We will not be responsible for, or indemnify you against, any liability you may incur. |

|

|

In connection with the exchange offer, you will be required to acknowledge that you are not engaged in, and do not intend to engage in, the distribution of the new notes. In addition, any broker-dealer that acquires new notes in the exchange offer for its own account in exchange for old notes which it acquired through market-making or other trading activities may be an "underwriter" within the meaning of the Securities Act and must acknowledge that it will deliver a prospectus when it resells or transfers any new notes. See "Plan of Distribution" for a description of the prospectus delivery obligations of broker-dealers in the exchange offer. |

THE NEW NOTES

The terms of the new notes and those of the old notes are identical in all material respects, except:

8

A brief description of the material terms of the new notes follows:

Issuer |

Huntsman International LLC. | |

Notes Offered |

€300.0 million in aggregate principal amount of 5.125% senior notes due 2021. |

|

Maturity |

April 15, 2021. |

|

Form and Denomination |

The new notes will be issued in denominations of €100,000 and integral multiples of €1,000 in excess thereof, maintained in book-entry form. |

|

Interest |

The new notes will bear interest at a rate of 5.125% per annum, payable semi-annually on April 15 and October 15 of each year, commencing on April 15, 2014. Interest on the new notes will accrue from December 23, 2014. |

|

Guarantees |

The new notes will be unconditionally guaranteed by substantially all of our domestic subsidiaries and certain of our foreign subsidiary holding companies that are treated as U.S. entities for tax purposes. See "Description of New Notes—Brief Description of the Notes and the Guarantees—The Guarantees." |

|

Ranking |

The new notes: |

|

|

• will be our general unsecured senior obligations; |

|

|

• will rank equally in right of payment with our 4.875% Senior Notes due 2020 (the "Existing Senior Notes") and all of our existing and future senior indebtedness; |

|

|

• will rank senior in right of payment to our currently outstanding 8.625% Senior Subordinated Notes due 2020 and 2021, as well as future subordinated indebtedness, if any; |

|

|

• will be effectively subordinated to all existing and future secured indebtedness, including indebtedness under our senior secured credit facilities, to the extent of the value of the collateral securing such indebtedness; and |

|

|

• will be structurally subordinated to all of our existing and future indebtedness and other liabilities, including trade payables, of our nonguarantor subsidiaries. |

|

|

Since the notes are unsecured, in the event of a bankruptcy or insolvency, our secured creditors will have a prior secured claim to any collateral securing the debt owed to them. |

9

|

The guarantees: |

|

|

• will be the general unsecured senior obligations of the guarantors; |

|

|

• will rank equally in right of payment to the guarantees of the Existing Senior Notes and all existing and future senior indebtedness of the guarantors; |

|

|

• will be senior in right of payment to all existing and future subordinated indebtedness of the guarantors, if any; and |

|

|

• will be effectively subordinated to all of our existing and future secured indebtedness, including indebtedness under our senior secured credit facilities, to the extent of the value of the collateral securing such indebtedness. |

|

|

Since the guarantees are unsecured obligations of each guarantor, in the event of a bankruptcy or insolvency, such guarantor's secured creditors will have a prior secured claim to any collateral securing the debt owed to them. |

|

|

As of December 31, 2013, we and the guarantors had approximately $3.3 billion of outstanding senior indebtedness (excluding intercompany subsidiary indebtedness but including the note payable to our parent), of which approximately $1.4 billion was secured. Further and not included above, our subsidiaries which are not guarantors had approximately $592 million of indebtedness (excluding intercompany subsidiary indebtedness) outstanding on December 31, 2013. See "Note 28. Condensed Consolidating Financial Information" to the audited consolidated financial statements, for certain financial information about our nonguarantor subsidiaries. |

|

Optional Redemption |

We may, in whole at any time or in part from time to time prior to the date that is 90 days prior to the scheduled maturity date of the notes, redeem the notes at our option at a redemption price equal to 100% of the principal amount thereof plus the applicable "make-whole" premium as of, and accrued and unpaid interest and special interest, if any, to, but not including, the applicable redemption date. |

10

|

In addition, we may, in whole at any time or in part from time to time after the date that is 90 days prior to the final maturity date of the notes, redeem the notes at our option at a redemption price equal to 100% of the principal amount thereof plus accrued and unpaid interest and special interest, if any, to, but not including, the applicable redemption date. |

|

Change of Control |

If we undergo a change of control repurchase event (as defined in the indenture), we will be required to make an offer to purchase each holder's notes at a price equal to 101% of their face amount plus accrued and unpaid interest and special interest, if any, to the date of repurchase. "Description of New Notes—Change of Control." |

|

Certain Covenants |

The indenture governing the notes contains covenants that, among other things, limit our ability and the ability of certain of our subsidiaries to: |

|

|

• incur additional secured indebtedness; |

|

|

• incur indebtedness of nonguarantor subsidiaries; |

|

|

• engage in certain sale-leaseback transactions with affiliates; and |

|

|

• merge or consolidate with or into any other person or lease, sell or transfer substantially all our properties and assets. |

|

|

These covenants are subject to a number of important exceptions and qualifications, which are described in "Description of New Notes—Certain Covenants." |

|

Governing Law |

The notes and the indenture governing the notes are governed by New York law. |

|

No Prior Market |

The notes are a new issue of securities and there is currently no established trading market for the notes. An active or liquid market may not develop for the notes. The initial purchasers have advised us that they currently intend to make a market in these notes. However, the initial purchasers are not obligated to do so and they may discontinue market making at any time. See "Plan of Distribution." |

|

Risk Factors |

See "Risk Factors" beginning on page 14 of this prospectus for important information regarding us and this exchange offer. |

For additional information regarding the new notes, see "Description of New Notes."

11

FAILURE TO EXCHANGE YOUR OLD NOTES

The old notes which you do not tender or we do not accept will, following the exchange offer, continue to be restricted securities. Therefore, you may only transfer or resell them in a transaction registered under or exempt from the Securities Act and all applicable state securities laws. We will issue the new notes in exchange for the old notes under the exchange offer only following the satisfaction of the procedures and conditions described under the caption "The Exchange Offer."

Because we anticipate that most holders of the old notes will elect to exchange their old notes, we expect that the liquidity of the markets, if any, for any old notes remaining after the completion of the exchange offer will be substantially limited. Any old notes tendered and exchanged in the exchange offer will reduce the aggregate principal amount outstanding of the old notes.

OTHER DEBT

The indenture governing the notes limits our ability to incur additional debt. Consequently, we would be required to obtain an amendment of the indenture before we incurred any additional debt, other than the types of debt specifically identified in the indenture as permitted.

SUMMARY HISTORICAL FINANCIAL DATA

The summary historical financial data set forth below presents our historical financial data as of and for the dates and periods indicated. You should review this summary historical financial data in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our audited consolidated financial statements and accompanying notes.

| |

Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in millions) |

2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||

Statements of Operations Data: |

||||||||||||||||

Revenues |

$ | 11,079 | $ | 11,187 | $ | 11,221 | $ | 9,250 | $ | 7,665 | ||||||

Gross profit |

1,770 | 2,041 | 1,858 | 1,478 | 1,095 | |||||||||||

Restructuring, impairment and plant closing costs |

151 | 92 | 167 | 29 | 88 | |||||||||||

Operating income |

533 | 869 | 629 | 443 | 41 | |||||||||||

Income (loss) from continuing operations |

152 | 380 | 257 | 144 | (399 | ) | ||||||||||

(Loss) income from discontinued operations, net of tax(a) |

(5 | ) | (7 | ) | (1 | ) | 42 | (19 | ) | |||||||

Extraordinary gain (loss) on the acquisition of a business, net of tax of nil(b) |

— | 2 | 4 | (1 | ) | 6 | ||||||||||

Net income (loss) |

147 | 375 | 260 | 185 | (412 | ) | ||||||||||

Net income (loss) attributable to Huntsman International LLC |

126 | 365 | 253 | 180 | (410 | ) | ||||||||||

Other Data: |

||||||||||||||||

Depreciation and amortization |

$ | 424 | $ | 408 | $ | 416 | $ | 382 | $ | 420 | ||||||

Capital expenditures |

471 | 412 | 330 | 236 | 189 | |||||||||||

Balance Sheet Data (at period end): |

||||||||||||||||

Total assets |

$ | 9,411 | $ | 8,870 | $ | 8,330 | $ | 8,307 | $ | 7,693 | ||||||

Total debt(c) |

4,789 | 4,401 | 4,481 | 4,685 | 4,531 | |||||||||||

Total liabilities |

7,936 | 7,653 | 7,239 | 7,219 | 6,846 | |||||||||||

12

was sold on November 5, 2007, the North American polymers business was sold on August 1, 2007, the European base chemicals and polymers business was sold on December 29, 2006 and the TDI business was sold on July 6, 2005.

13

You should carefully consider the risks and uncertainties below and the other information contained in this prospectus before you decide whether to exchange your old notes for new notes. Any of the following risks could materially and adversely affect our business, results of operations and financial condition. In this section of the prospectus, references to the notes mean the new notes.

Risks Related to Our Business

Our industry is affected by global economic factors including risks associated with volatile economic conditions.

Our financial results are substantially dependent on overall economic conditions in the U.S., Europe and Asia. Declining economic conditions in all or any of these locations—or negative perceptions about economic conditions—could result in a substantial decrease in demand for our products and could adversely affect our business. For example, our operations in Europe have been impacted by the uncertain European economy. Additionally, recent weakening of currencies in some emerging countries increases the risk of financial contagion in emerging markets globally.

Uncertain economic conditions and market instability make it particularly difficult for us to forecast demand trends. The timing and extent of any changes to currently prevailing market conditions is uncertain, and supply and demand may be unbalanced at any time. As a consequence, we may not be able to accurately predict future economic conditions or the effect of such conditions on our financial condition or results of operations. We can give no assurances as to the timing, extent or duration of the current or future economic cycles impacting the chemical industry.

The markets for many of our products are cyclical and volatile, and we may experience depressed market conditions for such products.

Historically, the markets for many of our products have experienced alternating periods of tight supply, causing prices and profit margins to increase, followed by periods of capacity additions, resulting in oversupply and declining prices and profit margins. The volatility these markets experience occurs as a result of changes in the supply and demand for products, changes in energy prices and changes in various other economic conditions around the world. For example, demand for our products depends in part on the housing and construction industries. These industries are cyclical in nature and have historically been impacted by downturns in the economy. The cyclicality and volatility of our industry results in significant fluctuations in profits and cash flow from period to period and over the business cycle.

Planned disruptions in production at our manufacturing facilities and unplanned disruptions, such as natural disasters, may have a material impact on our business, results of operations and/or financial condition.

Manufacturing facilities in our industry are subject to planned and unplanned production shutdowns, turnarounds and outages. Any serious disruption at any of our facilities could impair our ability to use our facilities and have a material impact on our revenues and increase our costs and expenses. Alternative facilities with sufficient capacity may not be available, may cost substantially more or may take a significant time to increase production or qualify with our customers, each of which could negatively impact our business, results of operations and/or financial condition. Long-term production disruptions may cause our customers to seek alternative supply which could further adversely affect our profitability.

Unplanned production disruptions may occur for external reasons including natural disasters, weather, disease, supply disruptions particularly from sole-source suppliers, strikes, transportation interruption, government regulation, political unrest or terrorism, or internal reasons, such as fire,

14

unplanned maintenance or other manufacturing problems. In addition, many of our current and potential customers are concentrated in specific geographic areas including the U.S. Gulf Coast, which is subject to hurricanes. A disaster in one of these regions could have a material impact on our operations, operating results and financial condition.

While we maintain business recovery plans that are intended to allow us to recover from natural disasters or other events that could disrupt our business, we cannot provide assurances that our plans would fully protect us from all such disasters or events that might increase in frequency or intensity due to climate change. In addition, insurance may not adequately compensate us from any losses incurred as a result of natural or other disasters. In areas prone to frequent natural or other disasters, insurance may become increasingly expensive or not available at all. Furthermore, some potential climate-driven losses, particularly inundation due to sea-level rise, may pose long-term risks to our physical facilities such that operations cannot be restored in their current locations.

Our results of operations may be adversely affected by international business risks, including fluctuations in currency exchange rates, legal restrictions and taxes.

We conduct a majority of our business operations outside the U.S., and these operations are subject to risks normally associated with international operations. These risks include the need to convert currencies that may be received for our products into currencies in which we purchase raw materials or pay for services, which could result in a gain or loss depending on fluctuations in exchange rates. In addition, we translate our local currency financial results into U.S. dollars based on average exchange rates prevailing during the reporting period or the exchange rate at the end of that period. During times of a strengthening U.S. dollar, our reported international sales and earnings may be reduced because the local currency may translate into fewer U.S. dollars. Because we currently have significant operations located outside the U.S., we are exposed to fluctuations in global currency rates which may result in gains or losses on our financial statements.

Other risks of international operations include trade barriers, tariffs, exchange controls, national and regional labor strikes, social and political risks, general economic risks and required compliance with a variety of U.S. and foreign laws, including tax laws, the Foreign Corrupt Practices Act (and foreign equivalents), export controls and regulations administered by the Office of Foreign Assets Control. In addition, although we maintain an anti-corruption compliance program throughout our Company, violations of our compliance program may result in criminal or civil sanctions, including material monetary fines, penalties and other costs against us or our employees, and may have a material adverse effect on our business. Furthermore, in foreign jurisdictions where process of law may vary from country to country, we may experience difficulty in enforcing agreements. In jurisdictions where bankruptcy laws and practices may vary, we may experience difficulty collecting foreign receivables through foreign legal systems. The occurrence of these risks, among others, could disrupt the businesses of our international subsidiaries, which could significantly affect their ability to make distributions to us.

We operate in a significant number of jurisdictions, which contributes to the volatility of our effective tax rate. Changes in tax laws or the interpretation of tax laws in the jurisdictions in which we operate may affect our effective tax rate. In addition, generally accepted accounting principles in the U.S. ("GAAP" or "U.S. GAAP") has required us to place valuation allowances against our net operating losses and other deferred tax assets in a significant number of tax jurisdictions. These valuation allowances result from analysis of positive and negative evidence supporting the realization of tax benefits. Negative evidence includes a cumulative history of pre-tax operating losses in specific tax jurisdictions. Changes in valuation allowances have resulted in material fluctuations in our effective tax rate. Economic conditions may dictate the continued imposition of the current valuation allowances and potentially the establishment of new valuation allowances. While significant valuation allowances remain, our effective tax rate will likely continue to experience significant fluctuations.

15

Completion of the proposed acquisition of the Performance Additives and Titanium Dioxide businesses of Rockwood Holdings, Inc. is subject to various closing conditions. Failure to complete the acquisition could adversely affect our stock price and our future business and operations.

On September 17, 2013, we entered into an agreement to acquire the Performance Additives and Titanium Dioxide businesses of Rockwood Holdings, Inc. The completion of the proposed acquisition is subject to the satisfaction of various closing conditions, including regulatory approval in the European Union, and we cannot assure you that such conditions will be satisfied and that the acquisition will be successfully completed. If the acquisition is not consummated, our strategy for our Pigments segment and our Company will be impacted. Failure to consummate the transaction could cause the market price of our common to stock decline.

Our efforts to grow and transform our businesses may require significant investments; if our strategies are unsuccessful, our business, results of operations and/or financial condition may be materially adversely affected.

We continuously evaluate opportunities for growth and change. These initiatives may involve making acquisitions, entering into partnerships and joint ventures, divesting assets, creating new financial structures and building new facilities—any of which could require a significant investment and subject us to new kinds of risks. We have incurred indebtedness to finance these opportunities, and we may incur additional indebtedness to finance future initiatives. We could also issue additional shares of stock of the Company or our subsidiaries to finance such initiatives. If our strategies for growth and change are not successful, we could face increased financial pressure, such as increased cash flow demands, reduced liquidity and diminished access to financial markets and the equity value of our businesses could be diluted.

The implementation of strategies for growth and change may create additional risks, including:

Our inability to address these risks or other problems encountered in connection with our strategies for growth and change could have a material adverse effect on our business, results of operations and financial condition.

We may have difficulties integrating acquired businesses and as a result, our business, results of operations and/or financial condition may be materially adversely affected.

We have completed a number of acquisitions and we will continue to acquire additional businesses and enter into joint ventures as part of our strategy. Most recently, in September 2013, we agreed to buy the Performance Additives and Titanium Dioxide Businesses of Rockwood Holdings, Inc. for $1.1 billion. This acquisition would position our Company as the second largest global producer of titanium dioxide and inorganic color pigments.

Growth through acquisitions and joint ventures involves risks, including:

16

Our inability to address these risks could cause us to fail to realize the anticipated benefits of such acquisitions or joint ventures and could have a material adverse effect on our business, results of operations and financial condition.

If we are unable to execute our cost reduction plans successfully, our total operating costs may be greater than expected, which may adversely affect our profitability.

We have undertaken a number of actions to restructure our Polyurethanes, Textile Effects, Advanced Materials and Performance Products segments to improve our earnings profile. We have implemented a number of these programs and have realized a portion of the anticipated benefits. While we continue to search for opportunities to reduce our costs and expenses to improve operating profitability without jeopardizing the quality of our products or the effectiveness of our operations, our success in achieving targeted cost and expense reductions depends upon a number of factors. If we do not successfully execute on our cost reduction initiatives or if we experience delays in completing the implementation of these initiatives, our results of operations or financial condition could be adversely affected.

Significant price volatility or interruptions in supply of our raw materials may result in increased costs that we may be unable to pass on to our customers, which could reduce our profitability.

The prices of the raw materials that we purchase from third parties are cyclical and volatile. We purchase a substantial portion of our raw materials from third- party suppliers. The cost of these raw materials represents a substantial portion of our operating expenses. The prices for a number of these raw materials generally follow price trends of, and vary with market conditions for, crude oil and natural gas feedstocks, which are highly volatile and cyclical.

In general, the feedstocks and other raw materials we consume are organic commodity products that are readily available at market prices. We frequently enter into supply agreements with particular suppliers, but disruptions of existing supply could substantially impact our profitability. If certain of our suppliers are unable to meet their obligations under present supply agreements, we may be forced to pay higher prices to obtain the necessary raw materials from other sources and we may not be able to increase prices for our finished products to recoup the higher raw materials costs. In addition, if raw materials become unavailable within a geographic area from which they are now sourced, then we may not be able to obtain suitable or cost effective substitutes. Any interruption in the supply of raw materials could increase our costs or decrease our revenues, which could reduce our cash flow.

Our supply agreements typically provide for market-based pricing and provide us only limited protection against price volatility. While we attempt to match cost increases with corresponding product price increases, we are not always able to raise product prices immediately or at all. Timing differences between raw material prices, which may change daily, and contract product prices, which in many cases are negotiated only monthly or less often, have had and may continue to have a negative effect on our cash flow. Any cost increase that we are not able to pass on to our customers could have a material adverse effect on our business, results of operations, financial condition and liquidity.

17

We are subject to risks relating to our information technology systems, and any failure to adequately protect our critical information technology systems could materially affect our operations.

We rely on information technology systems across our operations, including for management, supply chain and financial information and various other processes and transactions. Our ability to effectively manage our business depends on the security, reliability and capacity of these systems. Information technology system failures, network disruptions or breaches of security could disrupt our operations, cause delays or cancellations of customer orders or impede the manufacture or shipment of products, processing of transactions or reporting of financial results. An attack or other problem with our systems could also result in the disclosure of proprietary information about our business or confidential information concerning our customers or employees, which could result in significant damage to our business and our reputation.

We have put in place security measures designed to protect against the misappropriation or corruption of our systems, intentional or unintentional disclosure of confidential information, or disruption of our operations. Current employees have, and former employees may have, access to a significant amount of information regarding our operations which could be disclosed to our competitors or otherwise used to harm us. Moreover, our operations in certain locations, such as China, may be particularly vulnerable to security attacks or other problems. Any breach of our security measures could result in unauthorized access to and misappropriation of our information, corruption of data or disruption of operations or transactions, any of which could have a material adverse effect on our business.

In addition, we could be required to expend significant additional amounts to respond to information technology issues or to protect against threatened or actual security breaches. We may not be able to implement measures that will protect against all of the significant risks to our information technology systems.

The industries in which we compete are highly competitive, and we may not be able to compete effectively with our competitors that have greater financial resources, which could have a material adverse effect on our business, results of operations and financial condition.

The industries in which we operate are highly competitive. Among our competitors are some of the world's largest chemical companies and major integrated petroleum companies that have their own raw material resources. Changes in the competitive landscape could make it difficult for us to retain our leadership position in various products and markets throughout the world. In addition, some of the companies with whom we compete may be able to produce products more economically than we can. Furthermore, some of our competitors have greater financial resources, which may enable them to invest significant capital into their businesses, including expenditures for research and development. Some of our competitors are owned or partially owned by foreign governments which may provide a competitive advantage to those competitors. While we are engaged in a range of research and development programs to develop new products and processes, to improve and refine existing products and processes, and to develop new applications for existing products, the failure to develop new products, processes or applications could make us less competitive. Moreover, if any of our current or future competitors develops proprietary technology that enables them to produce products at a significantly lower cost, our technology could be rendered uneconomical or obsolete. Further, it is possible that we could abandon certain products, processes, or applications due to potential infringement of third party intellectual property rights or that we could be named in future litigation for the infringement or misappropriation of a competitor's or other third party's intellectual property rights, which could include a claim for injunctive relief and damages, and, if so, such adverse results could have a material adverse effect on our business, results of operations and financial position.

18

Certain of our businesses use technology that is widely available. Accordingly, barriers to entry, apart from capital availability, may be low in certain product segments of our business, and the entrance of new competitors into the industry may reduce our ability to capture improving profit margins in circumstances where capacity utilization in the industry is increasing. Further, petroleum-rich countries have become more significant participants in the petrochemical industry and may expand their roles significantly in the future. Increased competition in any of our businesses could compel us to reduce the prices of our products, which could result in reduced profit margins and loss of market share and have a material adverse effect on our business, results of operations, financial condition and liquidity.

Our operations involve risks that may increase our operating costs, which could reduce our profitability.

Although we take precautions to enhance the safety of our operations and minimize the risk of disruptions, our operations are subject to hazards inherent in the manufacturing and marketing of chemical products. These hazards include: chemical spills, pipeline leaks and ruptures, storage tank leaks, discharges or releases of toxic or hazardous substances or gases and other hazards incident to the manufacturing, processing, handling, transportation and storage of dangerous chemicals. We are also potentially subject to other hazards, including natural disasters and severe weather; explosions and fires; transportation problems, including interruptions, spills and leaks; mechanical failures; unscheduled downtimes; labor difficulties; remediation complications; and other risks. Many potential hazards can cause bodily injury and loss of life, severe damage to or destruction of property and equipment and environmental damage, and may result in suspension of operations and the imposition of civil or criminal penalties and liabilities. Furthermore, we are subject to present and future claims with respect to workplace exposure, exposure of contractors on our premises as well as other persons located nearby, workers' compensation and other matters.

We maintain property, business interruption, products liability and casualty insurance policies which we believe are in accordance with customary industry practices, as well as insurance policies covering other types of risks, including pollution legal liability insurance, but we are not fully insured against all potential hazards and risks incident to our business. Each of these insurance policies is subject to customary exclusions, deductibles and coverage limits, in accordance with industry standards and practices. As a result of market conditions, premiums and deductibles for certain insurance policies can increase substantially and, in some instances, certain insurance may become unavailable or available only for reduced amounts of coverage. If we were to incur a significant liability for which we were not fully insured, it could have a material adverse effect on our business, results of operations, financial condition and liquidity.

In addition, we are subject to various claims and litigation in the ordinary course of business. We are a party to various pending lawsuits and proceedings. For more information, see "Business—Legal Proceedings" below. It is possible that judgments could be rendered against us in these cases or others for which we could be uninsured or not covered by indemnity, or which may be beyond the amounts that we currently have reserved or anticipate incurring for such matters.

Financial difficulties and related problems at our customers, vendors, suppliers and other business partners could have a material adverse effect on our business.

During periods of economic disruption, more of our customers than normal may experience financial difficulties, including bankruptcies, restructurings and liquidations, which could affect our business by reducing sales, increasing our risk in extending trade credit to customers and reducing our profitability. A significant adverse change in a customer relationship or in a customer's financial position could cause us to limit or discontinue business with that customer, require us to assume more credit risk relating to that customer's receivables or limit our ability to collect accounts receivable from that customer. In addition, we rely on a number of vendors and suppliers and collaborations with other

19

industry participants to provide us with chemicals, feedstocks and other raw materials, along with energy sources and, in certain cases, facilities, that we need to operate our business. During periods of economic disruption, some of these companies could be forced to reduce their output, shut down their operations or file for bankruptcy protection. If this were to occur, it could adversely affect their ability to provide us with the raw materials, energy sources or facilities that we need, which could materially disrupt our operations, including the production of certain of our products. Moreover, it could be difficult to find replacements for certain of our business partners without incurring significant delays or cost increases. All of these risks could have a material adverse effect on our business, results of operations, financial condition and liquidity.

We are subject to many environmental, health and safety regulations that may result in unanticipated costs or liabilities, which could reduce our profitability.

We are subject to extensive federal, state, local and foreign laws, regulations, rules and ordinances relating to pollution, protection of the environment and human health and safety, and the generation, storage, handling, transportation, treatment, disposal and remediation of hazardous substances and waste materials. Actual or alleged violations of environmental, health and safety or EHS, laws or permit requirements could result in restrictions or prohibitions on plant operations and substantial civil or criminal sanctions, as well as, under some EHS laws, the assessment of strict liability and/or joint and several liability.

Governmental, regulatory and societal demands for increasing levels of product safety and environmental protection could result in increased pressure for more stringent regulatory control with respect to the chemical industry. In addition, these concerns could influence public perceptions regarding our products and operations, the viability of certain products, our reputation, the cost to comply with regulations, and the ability to attract and retain employees. Moreover, changes in EHS regulations could inhibit or interrupt our operations, or require us to modify our facilities or operations. Accordingly, environmental or regulatory matters may cause us to incur significant unanticipated losses, costs or liabilities, which could reduce our profitability.

We could incur significant expenditures in order to comply with existing or future EHS laws. Capital expenditures and costs relating to EHS matters will be subject to evolving regulatory requirements and will depend on the timing of the promulgation and enforcement of specific standards which impose requirements on our operations. Capital expenditures and costs beyond those currently anticipated may therefore be required under existing or future EHS laws.

Furthermore, we may be liable for the costs of investigating and cleaning up environmental contamination on or from our properties or at off-site locations where we disposed of or arranged for the disposal or treatment of hazardous materials or from disposal activities that pre-dated our purchase of our businesses. We may therefore incur additional costs and expenditures beyond those currently anticipated to address all such known and unknown situations under existing and future EHS laws.

Our operations, financial condition and liquidity could be adversely affected by legal claims against us, including antitrust claims.

We face risks arising from various legal actions, including matters relating to antitrust, product liability, intellectual property and environmental claims. Over the past few years, antitrust claims have been made against chemical companies, and we have been named as a defendant in the antitrust suits discussed in "Business—Legal Proceedings" below. In this type of litigation, the plaintiffs generally seek treble damages, which may be significant. An adverse outcome in any antitrust claim could be material and significantly impact our operations, financial condition and liquidity.

20

Our business is dependent on our intellectual property. If our intellectual property rights cannot be enforced or our trade secrets become known to our competitors, our ability to compete may be adversely affected.

Proprietary protection of our processes, apparatuses and other technology is important to our business. While a presumption of validity exists with respect to patents issued to us in the U.S., there can be no assurance that any of our patents will not be challenged, invalidated, circumvented or rendered unenforceable. Furthermore, if any pending patent application filed by us does not result in an issued patent, or if patents are issued to us, but such patents do not provide meaningful protection of our intellectual property, then our ability to compete may be adversely affected. Additionally, our competitors or other third parties may obtain patents that restrict or preclude our ability to lawfully produce or sell our products in a competitive manner, which could have a material adverse effect on our business, results of operations, financial condition and liquidity.

We also rely upon unpatented proprietary know-how and continuing technological innovation and other trade secrets to develop and maintain our competitive position. While it is our policy to enter into agreements imposing confidentiality obligations upon our employees and third parties to protect our intellectual property, these confidentiality obligations may be breached, may not provide meaningful protection for our trade secrets or proprietary know-how, or adequate remedies may not be available in the event of an unauthorized access, use or disclosure of our trade secrets and know-how. In addition, others could obtain knowledge of our trade secrets through independent development or other access by legal means.

We may have to rely on judicial enforcement of our patents and other proprietary rights. We may not be able to effectively protect our intellectual property rights from misappropriation or infringement in countries where effective patent, trademark, trade secret and other intellectual property laws and judicial systems may be unavailable, or may not protect our proprietary rights to the same extent as U.S. law.

The failure of our patents or confidentiality agreements to protect our processes, apparatuses, technology, trade secrets or proprietary know-how or the failure of adequate legal remedies for related actions could have a material adverse effect on our business, results of operations, financial condition and liquidity.

Conflicts, military actions, terrorist attacks and general instability, in particular in certain energy-producing nations, along with increased security regulations related to our industry, could adversely affect our business.

Conflicts, military actions and terrorist attacks have precipitated economic instability and turmoil in financial markets. Instability and turmoil, particularly in energy-producing nations, may result in raw material cost increases. The uncertainty and economic disruption resulting from hostilities, military action or acts of terrorism may impact any or all of our facilities and operations or those of our suppliers or customers. Accordingly, any conflict, military action or terrorist attack that impacts us or any of our suppliers or customers, could have a material adverse effect on our business, results of operations, financial condition and liquidity.

In addition, a number of governments have instituted regulations attempting to increase the security of chemical plants and the transportation of hazardous chemicals, which could result in higher operating costs and could have a material adverse effect on our financial condition and liquidity.

If our subsidiaries do not make sufficient distributions to us, then we will not be able to make payment on our debts.

Our debt is generally the exclusive obligation of our Company and our guarantor subsidiaries. Because a significant portion of our operations are conducted by nonguarantor subsidiaries, our cash flow and our ability to service indebtedness, including our ability to pay the interest on our debt when

21

due and principal of such debt at maturity, are dependent to a large extent upon cash dividends and distributions or other transfers from such nonguarantor subsidiaries. Any payment of dividends, distributions, loans or advances by our nonguarantor subsidiaries to us could be subject to restrictions on dividends or repatriation of earnings under applicable local law, monetary transfer restrictions and foreign currency exchange regulations in the jurisdictions in which our subsidiaries operate, and any restrictions imposed by the current and future debt instruments of our nonguarantor subsidiaries. In addition, payments to us by our subsidiaries are contingent upon our subsidiaries' earnings.

Our subsidiaries are separate legal entities and, except for our guarantor subsidiaries, have no obligation, contingent or otherwise, to pay any amounts due on our debt or to make any funds available for those amounts, whether by dividends, loans, distributions or other payments, and do not guarantee the payment of interest on, or principal of, our debt. Any right that we have to receive any assets of any of our subsidiaries that are not guarantors upon the liquidation or reorganization of any such subsidiary, and the consequent right of holders of notes to realize proceeds from the sale of their assets, will be structurally subordinated to the claims of that subsidiary's creditors, including trade creditors and holders of debt issued by that subsidiary.

Regulatory or market changes with respect to MTBE may materially reduce our sales and/or materially increase our costs.

We produce MTBE, an oxygenate that is blended with gasoline to reduce vehicle air emissions and to enhance the octane rating of gasoline. Because MTBE has contaminated some water supplies, its use has become controversial in the U.S. and elsewhere, and its use has been effectively eliminated in the U.S. market. We currently market MTBE, either directly or through third parties, to gasoline additive customers located outside the U.S. This business has been profitable to us over time, and future legislative or regulatory initiatives outside the U.S. restricting MTBE could materially adversely affect our ability to market and sell MTBE and our profitability. We have recently announced a joint venture with Sinopec involving the construction and operation of a PO/MTBE facility in China, which will further expose us to these risks.

While we could use all or a portion of our precursor TBA to produce saleable products other than MTBE, this would require significant capital expenditures to modify our facilities. Moreover, the sale of other products would produce a lower level of cash flow than that historically produced from the sale of MTBE.

Regulatory requirements to reduce emissions of greenhouse gases could have an adverse effect on our results of operations.

Globally, our operations are increasingly subject to regulations that seek to reduce emissions of greenhouse gases, or GHGs, such as carbon dioxide and methane, which may be contributing to changes in the Earth's climate. At the Durban negotiations of the Conference of the Parties to the Kyoto Protocol in 2012, a limited group of nations, including the European Union, agreed to a second commitment period for the Kyoto Protocol, an international treaty that provides for reductions in GHG emissions. More significantly, the European Union GHG Emissions Trading System, established pursuant to the Kyoto Protocol to reduce GHG emissions in the European Union, continues in its third phase. The European Union parliament continues with a process to formalize "backloading"—the withholding of GHG allowances to prop up carbon prices. In addition, the European Union has recently announced its intention to cut GHG emissions to 40% below 1990 levels by 2040 and impose a 27% renewable energy requirement at the European Union level. Collectively, these actions may increase our operating costs. In the United States, California has commenced the first compliance period of its cap-and-trade program. Finally, China has launched four regional cap-and-trade programs that will ultimately serve as the backbone of a national cap-and-trade program. To the extent that these

22

cap-and-trade programs impose compliance obligations upon our operations, they may increase our operating costs.

Federal climate change legislation in the United States appears unlikely in the near-term. As a result, domestic efforts to curb GHG emissions will continue to be led by the EPA's GHG regulations and the efforts of states. To the extent that our domestic operations are subject to the EPA's GHG regulations, we may face increased capital and operating costs associated with new or expanded facilities. Expansions of our existing facilities or construction of new facilities may be subject to the CAA's Prevention of Significant Deterioration requirements under the EPA's GHG "Tailoring Rule." Our facilities are also subject to the EPA's Mandatory Reporting of Greenhouse Gases rule, and the collection and reporting of GHG data may increase our operational costs.

Under a consent decree with states and environmental groups, the EPA is due to propose new source performance standards for GHG emissions from refineries. These standards could significantly increase the costs of constructing or adding capacity to refineries and may ultimately increase the costs or decrease the supply of refined products. Either of these events could have an adverse effect on our business.

We are already managing and reporting GHG emissions, to varying degrees, as required by law for our sites in locations subject to Kyoto Protocol obligations and/or European Union emissions trading scheme requirements. Although these sites are subject to existing GHG legislation, few have experienced or anticipate significant cost increases as a result of these programs, although it is possible that GHG emission restrictions may increase over time. Potential consequences of such restrictions include capital costs to modify operations as necessary to meet GHG emission limits and/or additional in energy costs, as well as direct compliance costs. Currently, however, it is not possible to estimate the likely financial impact of potential future regulation on any of our sites.

Finally, it should be noted that some scientists have concluded that increasing concentrations of GHGs in the earth's atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts, floods and other climatic events. If any of those effects were to occur, they could have an adverse effect on our facilities and operations.

Our pension and postretirement benefit plan obligations are currently underfunded, and under certain circumstances we may have to significantly increase the level of cash funding to some or all of these plans, which would reduce the cash available for our business.

We have unfunded obligations under our domestic and foreign pension and postretirement benefit plans and will assume additional unfunded pension obligations as part of our announced acquisition of the Performance Additives and Titanium Dioxide businesses of Rockwood Holdings, Inc. The funded status of our pension plans is dependent upon many factors, including returns on invested assets, the level of certain market interest rates and the discount rate used to determine pension obligations. Unfavorable returns on the plan assets or unfavorable changes in applicable laws or regulations could materially change the timing and amount of required plan funding, which would reduce the cash available for our business. In addition, a decrease in the discount rate used to determine pension obligations could result in an increase in the valuation of pension obligations, which could affect the reported funding status of our pension plans and future contributions, as well as the periodic pension cost in subsequent fiscal years.

Under the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), the Pension Benefit Guaranty Corporation ("PBGC") has the authority to terminate an underfunded tax-qualified pension plan under limited circumstances. In the event our tax-qualified pension plans are terminated by the PBGC, we could be liable to the PBGC for the entire amount of the underfunding and, under certain circumstances, the liability could be senior to the notes.

23

Risks Related to Our Indebtedness and the Notes

Our significant debt level, a portion of which is subject to variable interest rates, makes us vulnerable to downturns and may limit our ability to respond to market conditions or to obtain additional financing.

We have significant outstanding debt; as of December 31, 2013, our total consolidated outstanding debt was $4.8 billion (including current portion of debt); our debt to total capitalization ratio was approximately 76%; our combined outstanding variable rate borrowings were approximately $2.7 billion; and our current portion of debt totaled $277 million. Our debt level, and the fact that a significant percentage of our cash flow is required to make payments on our debt, could have important consequences for our business, including but not limited to the following:

Our debt level also impacts our credit ratings. Any decision by credit rating agencies to downgrade our debt ratings could restrict our ability to obtain additional financing and could result in increased interest and other costs.

Despite our current levels of indebtedness, we may incur substantially more debt, which could further increase the risks associated with our substantial indebtedness.